Compound Interest Calculator

Determine how much your money can grow using the power of compound interest.

Understanding Compound Interest: A Comprehensive Guide with Examples and Tools

Compound interest is one of the most powerful concepts in finance and investing. It refers to the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. This article will explore compound interest in detail, including how to calculate it, the benefits of using a compound interest calculator, and practical examples illustrated with tables and graphs.

What is Compound Interest?

Compound interest differs from simple interest, which is calculated only on the principal amount. With compound interest, the interest earned over time is added to the principal, and the subsequent interest calculations are based on this new total. This process can lead to exponential growth of the investment or loan amount.

The Formula for Compound Interest

The formula for calculating compound interest is:

A = P (1 + r/n)^(nt)

Where:

- A = the amount of money accumulated after n years, including interest.

- P = the principal amount (the initial amount of money).

- r = the annual interest rate (decimal).

- n = the number of times that interest is compounded per year.

- t = the number of years the money is invested or borrowed.

Example of Compound Interest Calculation

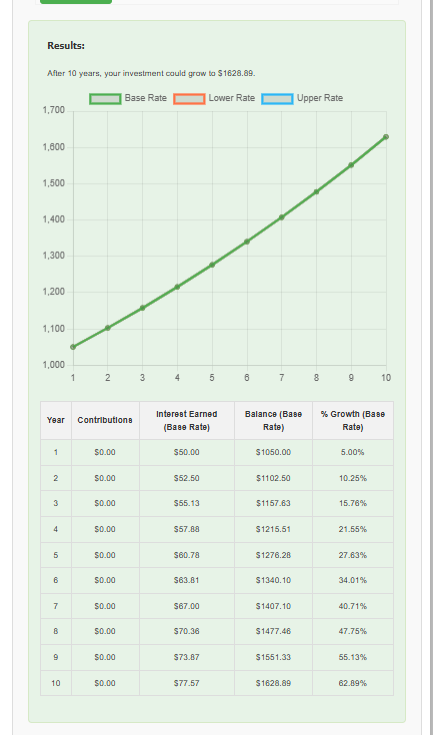

Let’s say you invest $1,000 at an annual interest rate of 5%, compounded annually for 10 years. We can use the formula to find out how much you would have at the end of this period.

- Identify the Variables:

- P = 1000

- r = 0.05 (5%)

- n = 1 (compounded annually)

- t = 10

- Plug the Values into the Formula:

A = 1000 (1 + 0.05)^(10)

A = 1000 * (1.05)^(10)

A = 1000 * 1.62889 ≈ 1628.89

After 10 years, your investment would grow to approximately $1,628.89.

Compound Interest Table

| Year | Principal | Interest Earned | Total Amount |

|---|---|---|---|

| 0 | $1,000.00 | $0.00 | $1,000.00 |

| 1 | $1,000.00 | $50.00 | $1,050.00 |

| 2 | $1,050.00 | $52.50 | $1,102.50 |

| 3 | $1,102.50 | $55.13 | $1,157.63 |

| 4 | $1,157.63 | $57.88 | $1,215.51 |

| 5 | $1,215.51 | $60.78 | $1,276.29 |

| 6 | $1,276.29 | $63.81 | $1,340.10 |

| 7 | $1,340.10 | $67.00 | $1,407.10 |

| 8 | $1,407.10 | $70.36 | $1,477.46 |

| 9 | $1,477.46 | $73.87 | $1,551.33 |

| 10 | $1,551.33 | $77.57 | $1,628.89 |

Compound Interest Graph

Below is a graphical representation of the growth of the investment over 10 years.

Note: Please create this graph using a tool like Excel or Google Sheets, plotting the total amount against the years to visualize exponential growth.

Benefits of Using a Compound Interest Calculator

A compound interest calculator simplifies the process of calculating the growth of investments. It provides a user-friendly interface where you can input your principal, interest rate, compounding frequency, and time period to quickly see the results.

Key Benefits Include:

- Time-Saving: Quickly compute potential returns without manual calculations.

- Visualization: Many calculators offer graphical outputs to help you understand growth trends.

- Scenario Testing: Easily adjust variables to see how changes affect your investment’s growth.

- Planning Tool: Helps in financial planning for future investments or savings goals.

Real-Life Applications of Compound Interest

Savings Accounts

Most savings accounts use compound interest. Banks calculate interest daily, monthly, or quarterly, making your money grow faster than with simple interest.

Retirement Accounts

Retirement accounts, such as IRAs or 401(k)s, often leverage compound interest. Starting early and making regular contributions can lead to significant growth over time.

Loans

Compound interest is not only beneficial for investments but can also work against you when it comes to loans, such as credit cards. Understanding how interest compounds on loans is crucial for financial literacy.

Example Scenarios

Scenario 1: Saving for College

Suppose you want to save for your child’s college education, which you estimate will cost $50,000 in 18 years. You decide to invest $10,000 at an interest rate of 6%, compounded annually.

- Calculate Future Value:

- P = 10,000

- r = 0.06

- n = 1

- t = 18

A = 10,000 (1 + 0.06)^(18)

A = 10,000 * (1.06)^(18) ≈ 10,000 * 2.854 ≈ 28,540

After 18 years, you will have approximately $28,540. If you want to reach $50,000, you might need to increase your contributions or find a higher interest rate.

Scenario 2: Investing in the Stock Market

Imagine you invest $5,000 in a diversified stock portfolio with an average annual return of 8%, compounded annually, over 30 years.

- Calculate Future Value:

- P = 5,000

- r = 0.08

- n = 1

- t = 30

A = 5,000 (1 + 0.08)^(30)

A = 5,000 * (1.08)^(30) ≈ 5,000 * 10.0627 ≈ 50,313.50

You would accumulate approximately $50,313.50 after 30 years, demonstrating the power of compounding over a long investment horizon.

Conclusion

Compound interest is a vital financial concept that can significantly impact your savings and investment strategies. By understanding how it works and utilizing tools like compound interest calculators, you can make informed decisions to maximize your financial growth. Whether you are saving for retirement, planning for your child’s education, or investing in the stock market, the benefits of compound interest can help you achieve your financial goals over time.

As you plan your financial future, remember that starting early and making regular contributions are key to harnessing the full power of compound interest. With patience and consistency, your investments can grow beyond your initial expectations.

Compound Interest Calculator

Unlike simple interest, which is calculated solely on the principal amount, compound interest takes into account not only the initial principal but also the accumulated interest from previous periods. This means that interest is earned on both the original amount and the interest that has been added to it over time.

The formula for calculating compound interest can be expressed as A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount, r is the annual interest rate (decimal), n is the number of times that interest is compounded per year, and t is the number of years the money is invested or borrowed. The power of compound interest lies in its ability to generate exponential growth over time. For instance, if an individual invests $1,000 at an annual interest rate of 5% compounded annually for 20 years, the investment will grow significantly more than if it were simply earning 5% simple interest.

This phenomenon is often referred to as "the miracle of compound interest," as it illustrates how money can grow at an accelerating rate. The longer the investment period and the more frequently the interest is compounded, the greater the total amount will be at the end of the investment horizon. This principle underscores the importance of starting to save and invest early, as even small amounts can lead to substantial wealth accumulation over time.

Key Takeaways

- Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods.

- A compound interest calculator works by taking into account the initial principal, interest rate, and time period to calculate the future value of an investment.

- Using a compound interest calculator can help individuals visualize the growth of their investments over time and make informed financial decisions.

- When using a compound interest calculator, it's important to consider factors such as the frequency of compounding and any additional contributions or withdrawals.

- There are different types of compound interest calculators available, including online tools, mobile apps, and financial software, each with their own unique features and benefits.

How Compound Interest Calculator Works

A compound interest calculator is a tool designed to simplify the process of calculating how much an investment will grow over time when compound interest is applied. These calculators typically require users to input several key variables: the principal amount, the annual interest rate, the number of times interest is compounded per year, and the duration of the investment in years. Once these inputs are provided, the calculator uses the compound interest formula to compute the future value of the investment.

When a user enters their data, the calculator performs a series of mathematical operations based on the formula mentioned earlier. It first determines how many compounding periods will occur over the specified duration by multiplying the number of years by the frequency of compounding (e.g., annually, semi-annually, quarterly, or monthly).

Then, it calculates the total amount of interest accrued during each compounding period and adds it to the principal. The result is a clear projection of how much money will be available at the end of the investment period, allowing users to visualize their financial growth.

Benefits of Using a Compound Interest Calculator

Utilizing a compound interest calculator offers numerous advantages for both novice and experienced investors. One of the primary benefits is its ability to provide quick and accurate calculations without requiring extensive mathematical knowledge. This accessibility empowers individuals to make informed financial decisions based on realistic projections of their investments.

By simply inputting their data into a user-friendly interface, users can instantly see how different variables—such as changes in interest rates or investment durations—affect their potential returns. Another significant benefit is that these calculators can help users set realistic financial goals. By experimenting with various scenarios, individuals can determine how much they need to invest regularly or what interest rate they should aim for to achieve their desired financial outcomes.

For example, someone planning for retirement can use a compound interest calculator to estimate how much they need to save each month to reach their target retirement fund. This capability not only aids in financial planning but also fosters a deeper understanding of how time and compounding work together to build wealth.

Factors to Consider When Using a Compound Interest Calculator

When using a compound interest calculator, several factors should be taken into account to ensure accurate and meaningful results. One critical aspect is understanding the frequency of compounding. Interest can be compounded annually, semi-annually, quarterly, monthly, or even daily.

The more frequently interest is compounded, the more significant the growth will be over time. Therefore, users should carefully consider how often their investments will actually compound when inputting data into the calculator. Another important factor is the choice of interest rate.

The annual percentage rate (APR) can vary widely depending on the type of investment or loan product being considered. For example, high-yield savings accounts may offer lower rates compared to stocks or mutual funds that have historically provided higher returns over long periods. Users should research and select realistic rates based on current market conditions and their specific investment vehicles.

Additionally, it’s essential to remember that past performance does not guarantee future results; thus, being conservative in estimating potential returns can lead to more prudent financial planning.

Different Types of Compound Interest Calculators

There are various types of compound interest calculators available online and through financial institutions, each designed for specific purposes and user needs. Basic calculators allow users to input standard variables such as principal amount, interest rate, compounding frequency, and investment duration to calculate future value. These tools are ideal for individuals looking for straightforward calculations without additional features.

More advanced calculators may offer additional functionalities such as tax implications, inflation adjustments, or comparisons between different investment options. For instance, some calculators allow users to simulate various scenarios by adjusting multiple variables simultaneously, providing a more comprehensive view of potential outcomes. There are also specialized calculators tailored for specific financial goals, such as retirement planning calculators that factor in expected withdrawals during retirement years or education savings calculators that help parents estimate how much they need to save for their children's college education.

Tips for Maximizing the Use of a Compound Interest Calculator

Defining Your Financial Objectives

To maximize the benefits of a compound interest calculator, it's essential to approach it with a clear understanding of your financial goals and objectives. Before entering data into the calculator, it's beneficial to outline specific targets, such as retirement savings goals or major purchases, and consider how different variables might impact those goals over time. This preparatory step can help you make more informed decisions when experimenting with various scenarios.

Comparing Calculators for Enhanced Insights

In addition to understanding your financial objectives, it's also crucial to take advantage of multiple compound interest calculators available online. Comparing results and features from different calculators can provide a more comprehensive understanding of compound interest and its applications. Different calculators may have unique interfaces or additional functionalities that could enhance your understanding or provide more tailored insights into specific financial situations.

Exploring Various Tools and Resources

By exploring various compound interest calculators and resources, you can gain a broader perspective on how compound interest works and how you can leverage it effectively in your financial planning. This will enable you to make more informed decisions about your financial future and create a more effective plan for achieving your goals.

Effective Financial Planning with Compound Interest

Ultimately, using a compound interest calculator effectively requires a combination of understanding your financial objectives, comparing different calculators, and exploring various tools and resources. By taking a comprehensive approach to compound interest, you can unlock its full potential and create a more secure financial future.

Common Mistakes to Avoid When Using a Compound Interest Calculator

While compound interest calculators are valuable tools for financial planning, users can easily make mistakes that lead to inaccurate results or misguided decisions. One common error is neglecting to account for all relevant variables when inputting data into the calculator. For instance, failing to specify the correct compounding frequency can significantly alter projections; using annual compounding instead of monthly compounding could result in underestimating potential returns.

Another frequent mistake involves using unrealistic assumptions about interest rates or investment durations. Users may be tempted to input overly optimistic rates based on past performance without considering current market conditions or economic factors that could affect future returns. It’s crucial to approach these calculations with a balanced perspective and consider conservative estimates that reflect potential risks and uncertainties in financial markets.

Resources for Finding a Reliable Compound Interest Calculator

Finding a reliable compound interest calculator is essential for accurate financial planning and investment decision-making. Numerous reputable financial websites offer free calculators that are easy to use and provide reliable results. Websites such as Bankrate, Investopedia, and NerdWallet feature user-friendly interfaces along with educational resources that explain how compound interest works and why it matters.

In addition to online calculators, many financial institutions provide their own tools for customers looking to plan their investments or savings strategies. Banks and credit unions often have dedicated sections on their websites where customers can access calculators tailored specifically for savings accounts, loans, or retirement planning. Utilizing these resources not only ensures accuracy but also allows users to explore additional financial products that may align with their goals while gaining insights from trusted institutions in the industry.

FAQs

What is compound interest?

Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods. This means that interest is earned on interest.

How is compound interest different from simple interest?

Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal amount and the accumulated interest from previous periods.

How is compound interest calculated?

Compound interest is calculated using the formula A = P(1 + r/n)^(nt), where: A = the amount of money accumulated after n years, including interest. P = the principal amount (initial amount of money). r = the annual interest rate (in decimal). n = the number of times that interest is compounded per year. t = the time the money is invested for in years.

What is a compound interest calculator?

A compound interest calculator is a tool that helps individuals calculate the amount of money they will have after a certain period of time, based on an initial investment, interest rate, and compounding frequency.

How can a compound interest calculator be used?

To use a compound interest calculator, individuals input the initial principal, interest rate, compounding frequency, and time period. The calculator then provides the amount of money that will be accumulated after the specified time period.